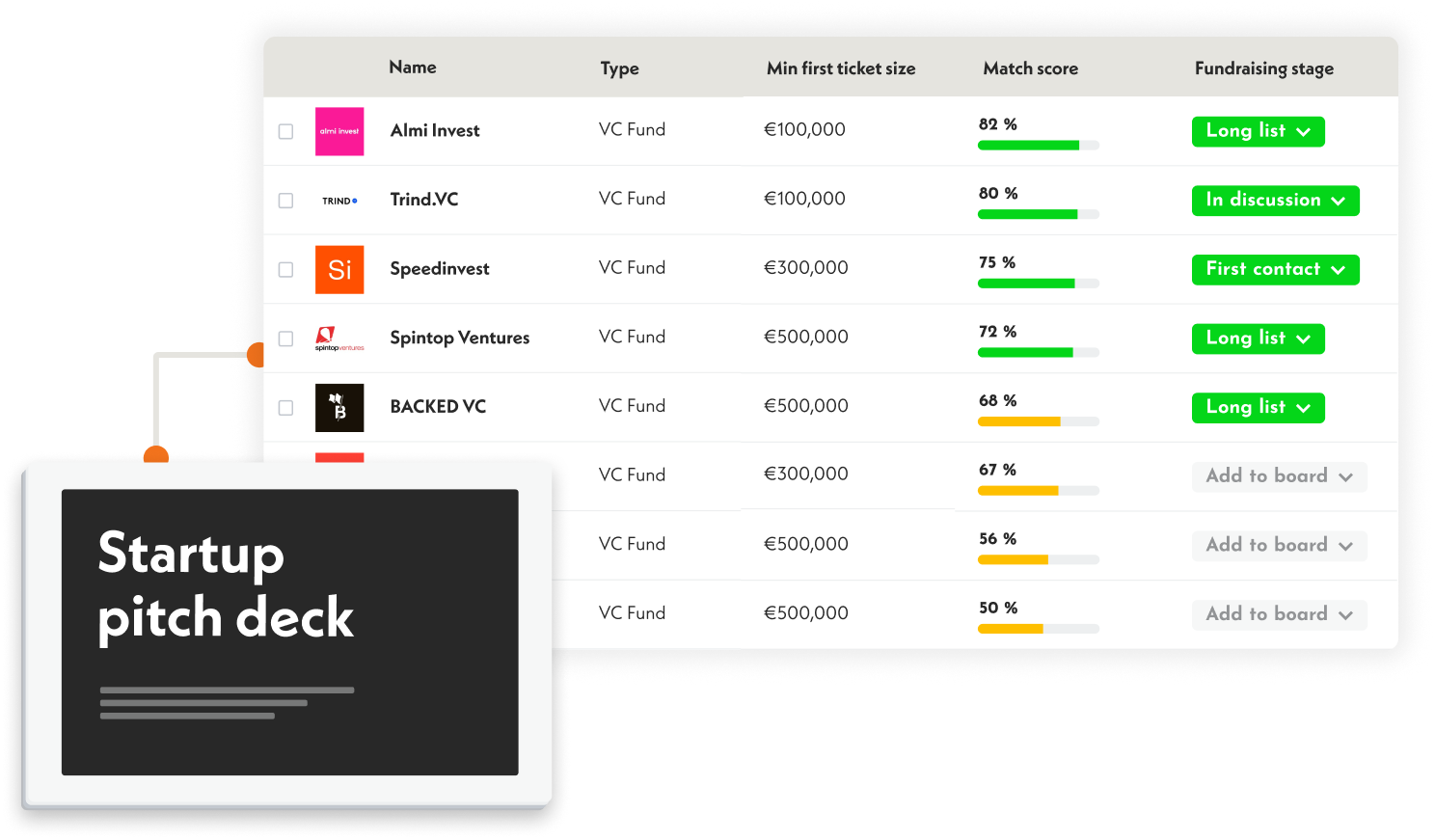

Build your investor list in minutes with AI

Avoid spending days and thousand of euros researching different investor databases. Just upload your pitch deck, answer a few questions and let AI find the most relevant investors in Europe.

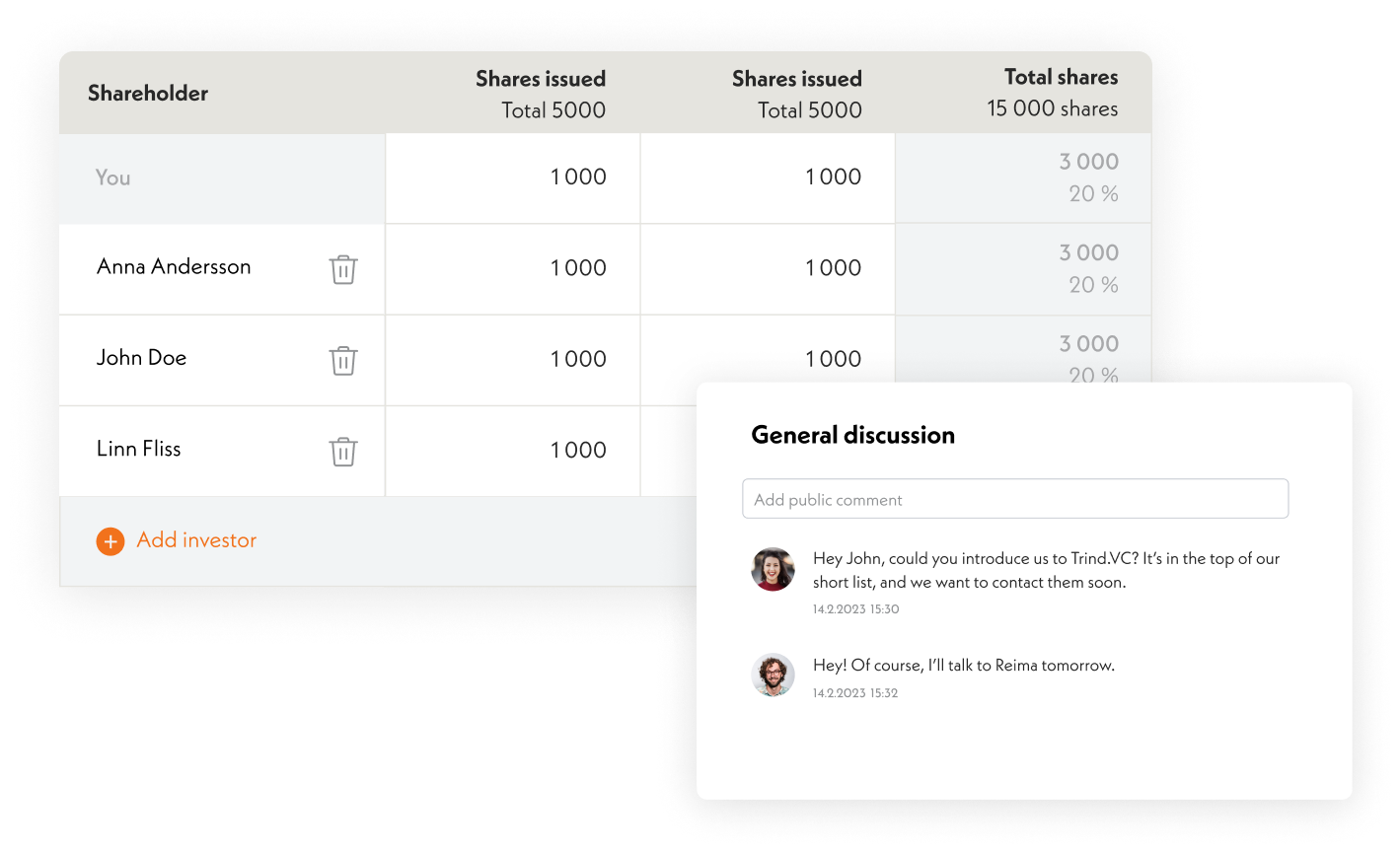

Unlock your network for warm introductions

Invite your shareholders, use their networks for warm introductions and highlight that you are already backed by others.

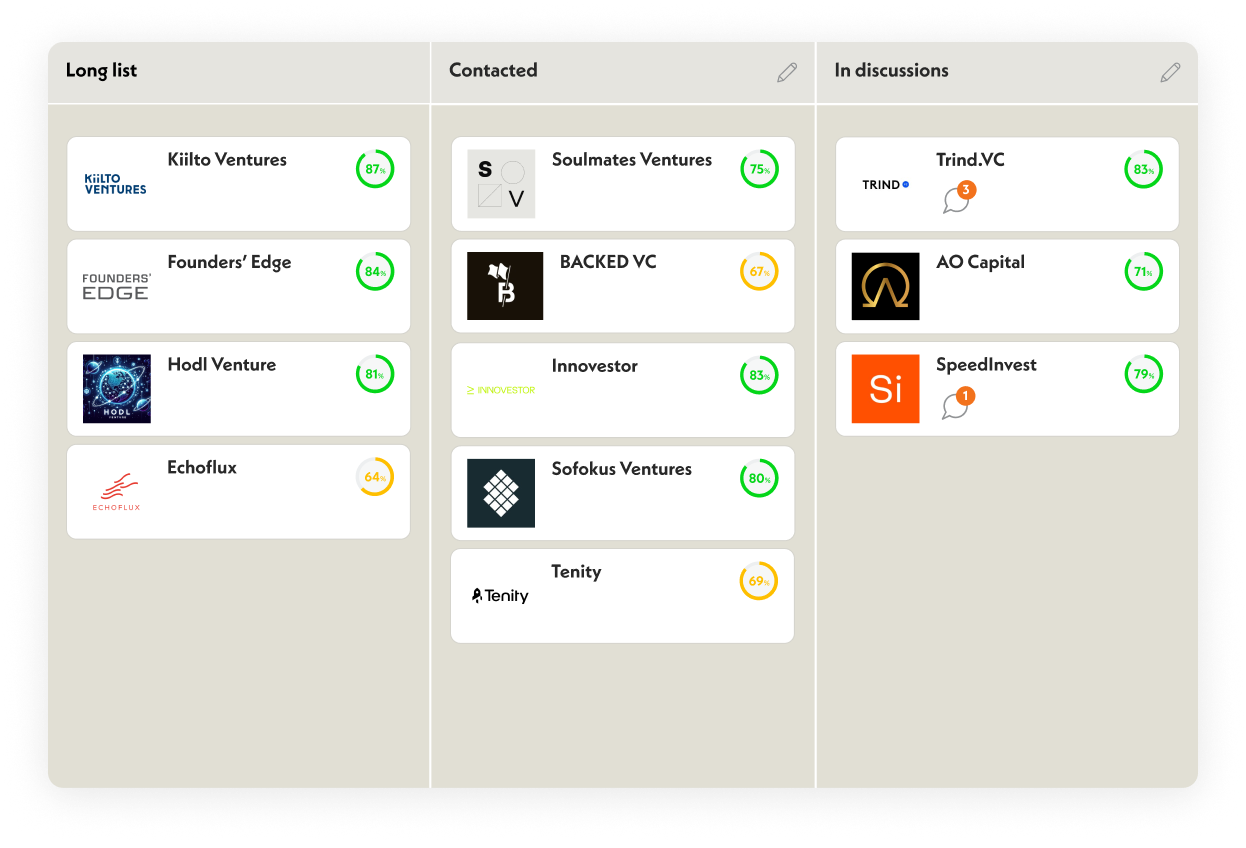

Keep everyone updated

Manage and follow your funnel in one place. Add notes, follow up on investor discussions, and keep your team up to date.

10x your chances of closing your raise with a systematic process

Fundraising is a daunting task. Running it as a systematic process will increase the likelihood of closing by 10x while also reducing 80% of the time spent.

Why our customers love us

“As an innovative zero waste natural cosmetics startup, it is not so easy to find investors who understand our business. It is nice to find tools that help you find the right people. Using Hopohopo.io can help to target the right investors.”

“Hopohopo.io helped us save time by revealing our investment readiness status. It also gave us some hints about investors' point of view and what they look for in startups when screening the applications.”

“Smart tool for helping hard-pressed founders to find the best sources of funding in a cost-effective manner without wasting time and money on dead-ends.”

Frequently Asked Questions

How do you ensure the quality of your platform data?

This is our bread and butter. Before Hopohopo.io, we built analytics and measurement technology to optimize large factory operations. Eventually, we exited the companies and transferred to the investment side.

Now we use learnings from building industrial-scale factory analytics to ensure data quality.

Here are a few examples of the principles we have in place:

We only publish data we can verify.

We track more than 50,000 investors, but we publish only around 3000 because we can be sure they are fit for early-stage startups. That's plenty enough to start shoveling.

We verify the information from the investors, but we sanity-check their input

The investor knows the best what they are doing. Or at least should 🙂So they are naturally our number one source.

But investors are asked to fill in their investment preferences in so many places that keeping them updated is a daunting task. Thus we use measures to update investor profiles automatically. For example, we monitor their portfolio companies to get the latest update on the industries they invest in.

Secondly, it’s tempting for some investors to answer that they invest in all industries across the globe. Most likely, they will not, and we look for proof to support their claims.

How many investors are there in your platform?

The big number is +50,000 investors. But that’s marketing, just to keep up with the competition 🙂

The problem with the big number is that it includes everyone who has ever invested in anything resembling a startup. So all family, friends, and fools, including the Hopohopo.io founders’ mothers (who also can be found in Pitchbook and Crunchbase), are often listed as investors, but they have no sheer intention to do it again.

Thus, the number of relevant, active investors focusing on early-stage European startups is currently around three thousand.

What are the types of investors and regions you cover?

The investors consist of VCs, Individual Business Angels or networks, and Accelerators investing in:

- Multiple deals per year in European startups

- Early-stage startups

- Pre-Seed, Seed, A-rounds & B-rounds

How do your matching algorithms work?

Well, it's a lot of code in detail 🙂 But at a high level, we automate what seems trivial but eventually takes a lot of your time. For example, we look at the industry, ticket size, focus areas, and naturally the stage, and geographical mandate, etc.

Secondly, it’s good to understand, it’s merely pre-qualification. We cannot say you will get married to the investor. Neither can Tinder. But what we do is to help you filter out the obvious non-matches, meaning investors who don’t invest in your country, industry, and so forth. This allows you to focus your time on the ones that have better chances of becoming your next investor.

Can I contact investors directly on Hopohopo.io?

Yes, you can. Many investors have enabled the platform's “easy share” functionality, which allows you to share deck and profile details directly on the platform.

That said, although as much as we would like, the world does not revolve around us. Nor you. Some investors prefer to be contacted by email, some via LinkedIn, and some only via personal introductions.

So you should not rely on just reaching via one channel. This is where Hopohopo.io CRM comes in handy—it keeps you on top of all the communications in different channels.

Can I use Hopohopo.io as CRM for investor relations?

Naturally. You can (and should) invite your current shareholders to follow up with your progress and ask them to help with warm introductions.

We are also working on an Investor reporting feature, so soon you can do all investor updates via our platform.

Do you offer training and service for fundraising?

Yes, we do.

We have a team of experts who have been on both sides of the table and raised more than €50M for startups.

Also, throughout the years, we have partnered with a pool of reliable experts who help startups raise capital in different stages, fields, and geographies.

Just reach out to us, and let's have a discovery call to assess whether our team or one of our partners can help.

Also, our platform is also used by the majority of European accelerators, so if you are interested in joining one, you can sign up from here and see which accelerator would be the best fit for you.

And if you’re interested in training material around fundraising, just check our training material on YouTube.